We had been wanting to write on this topic of managing money during travel, for a long time. Having travelled reasonably far and wide (40+ countries), a lot of people ask us, how to manage finance on the go, what type of savings account we use and tips for making the travel fund last longer. At this point, we will just touch upon the How to manage finance while travelling And leave the second question for another article 😊.

Planning & Budgeting

A plan is required, however incomplete or high level it maybe. It should at the very least have a list of places you are planning to go and for how many days. These two factors have a direct impact on your budget. What we will discuss here is mainly for travels spread over multiple weeks or months, when there are myriad little challenges.

A ball park or high-level budget is also a must unless you have very deep pockets, in which case you would not be reading this article, ha ha ha. 😀

Generally, we found that we could broadly categorize our expenses into three categories, Food, Accommodation and everything else. Each of them is almost one-third of the total budget. Add to that the one-time flight cost, travel insurance and visa fees, which are going to be spent upfront at the time of applying for visa. Of course, it all depends on the individual’s style. To each his/her own, as they say, but you get the drift.

Create pools of funds

Once a budget is made, you need to find those elusive crispy papers that we call money and for that I am sure each of us have our own little means and schemes.

Now to decide how are we going to carry these funds?

Bank Account

- We keep all the travel money as per budget and bit more (for us it is 20% more), in a joint zero balance account (meaning we can use up all the money in the account without incurring charges) and carry a debit card each for that.

- We also carry our individual bank debit cards as backup packed in a secret place. Sometimes it is so secret that I can’t find it when needed, so I let Nisha handle this part. 😀

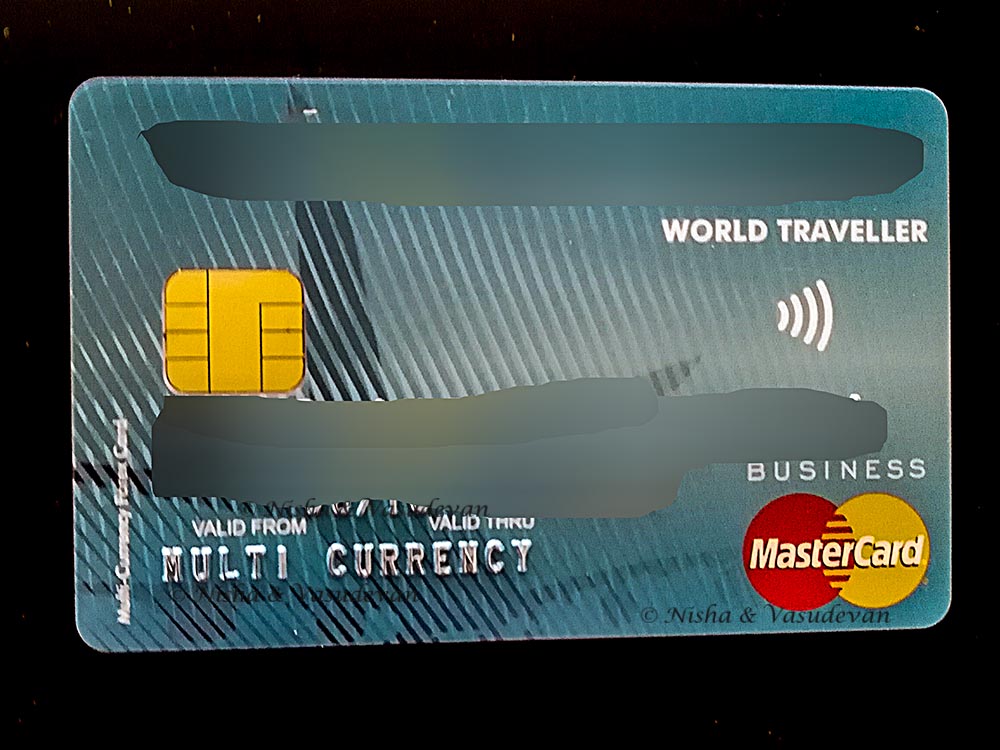

Foreign Exchange Prepaid Cards (Forex cards)

- Since most countries don’t deal with Indian Rupees, we exchange about 4 weeks’ worth of INR into foreign exchange currency cards secured by password or pin, EUR for Europe and USD for most other places. In fact, our prepaid forex cards could hold money in 10 different currencies at a time. This we found was the easiest way to transact business while on the move as compared to carrying cash. They can be used like a credit card and can be swiped at most POS (point of sales) machines abroad. There are no transaction fees as long as the billing currency is same as the forex in the card. Travel Fore card is called variously as travel money card, multi currency card, world card etc.

- We used two cards each of two different banks. It really takes care of the risk of losing a card. The card replacement process is a nightmare.

- Another advantage of forex cards is that the account can be viewed online and transferring funds to it is a breeze.

- I actually lost one of my forex cards, however we could block the card in time. It still had a lot of money in it but we got the amount transferred back to our savings account. In the process there was a reconversion charge which we had to bear.

- Disadvantage is, if you use it to withdraw cash from an ATM, there are low limits but high charges and we suggest not to use it at ATMs.

- As per the Indian law, the total foreign exchange available for Indian tourists traveling abroad is USD 10,000 per person per year.

- Out of that only USD 2,000 can be in cash, rest must be as foreign exchange card or traveller’s cheques (ugh!)or or bank drafts (who uses them?) or of course in an Indian bank that can be drawn using credit or ATM card.

- After returning any amount in excess of USD 2,000 per person must be returned to the bank within 90 days.

Credit Cards

- We carried our individual credit cards from two banks.

- We got the spending limit reduced to about INR 50,000 each (Less than USD 1000).

- This was important in order to limit the risk of credit card losses.

- We used the credit cards majorly to book hotels during travel and flights if need be.

- It is always a good idea to select the currency of the credit card (In our case Indian Rupees) in all the online portals. They have the best possible conversion rates and there are no explicit forex commissions. Also, Indian banks charge additional GST on top of the expense now. (earlier it used to be service tax + surcharge + cess and so on…it was a cesspool of sorts).

- I confess that I found it the hard way after using my credit card at a restaurant, where I should have used my forex card.

- Having said that, one can easily check the conversion rates by changing the currency and doing a quick math and checking that against published rates.

Cash

- Cash is still the most preferred form of transaction at smaller establishments and probably the only acceptable form at most of these places.

- We exchange a week’s worth of INR into a strong currency before leaving India.

- Generally, one week’s worth lasts more than a month keeping in view the above provisions.

- Before it ran out we would withdraw a month’s worth from a what we need depending on where we are and how much longer will be our stay.

- Most often there is a fixed charge per transaction from the local bank and it makes sense to withdraw a month’s worth. In the backend, we are subject to various commissions and taxes. We find this to be very safe as opposed to carrying cash for the entire period of stay. It is a balance you strike.

- However, if we need urgent cash in a country which is not listed as a strong currency then we just withdraw what we need before moving onto another country.

- It so happened in Bled, Slovenia, the homestay owner did not accept Forex Card (obviously!) and we were short of Euros (forgot to withdraw in Ljubljana). Fortunately, there was one ATM in Bled that was working and the owner took me in his car while Nisha rushed to the bus stop with the luggage as we were short on time as well. Ha Ha Ha. (We were not laughing at that time for sure). Slovenia being a Euro country worked for us as our next few stops were all Euro countries.

- Spread the cash around on your person and in your luggage to reduce the risk of loss. (and of course remember where you kept it too).

Tracking Expenses

We use a simple excel sheet full of formulae to help us monitor our expenses. We worry only when we are grossly overboard. That we believe, would take the fun out of travelling. One can’t be too rigid! Over a period of weeks and months it evens out anyway.

Conclusion

- Inform your credit card and debit card bank that you would be using these in a foreign country. You don’t want them to block your suspecting fraud.

- It is easier to plan when you are travelling to one or two countries for a couple of weeks where you have the option of carrying all the amount required in cash.

- For multiple weeks of travel in multiple countries, there is no way to avoid conversion taxes back home. During our #NiVaEuro trip of 100 plus days spanning over 10 countries, the cumulative total of Service Charges and taxes was about EUR50. It is not much in the overall scheme of things but it could have got us the squarest of the meals for the two of us in Europe or many meals back home in India. However, if you compare this against the risk of carrying the whole amount in cash, it is definitely worthwhile.

- The above plan also worked for us during our 100 plus days #NiVaEuro trip.

- If you are stuck with a weak currency, try to convert back to a strong currency before you leave that country, after keeping a few bills as souvenirs.

- Coins have a way of building up out of nowhere! There is not much one can do except try to spend it. Some stores give you the looks when you give them a lot of change, others actually help you get rid of them cheerfully because they are forever short of coins. It takes all types to make this world. At the end of our journey, we had almost 250gms in coins of multiple currencies. Ha Ha Ha 😀

Recommended Reads and Travel Tips:

60 Best Travel Tips.

How to use Transferwise.

If you want to travel places with us, we invite you to join us on our feed or Facebook travel page.

P.S.- This article How to Manage Finance while Travelling belongs to Le Monde, the Poetic Travels, an Indian Travel Blog, by the traveling couple, Nisha & Vasudevan. Reproduction without explicit permission is prohibited. If you are viewing this on another website rather than the RSS feed reader or www.lemonicks.com, then that website is guilty of stealing my content. Kindly do us a favour. Please visit our site and let us know. Thank you.

Ref : lemonicks_in03

After returning any amount in excess of USD 2,000 per person must be returned to the bank within 90 days. – this rule is stupid- why can’t we keep the cash for future trips? Why we should lose money in conversion multiple times?

This is such helpful one.Few queries I had in my mind for Forex which resolved via this post

Thank you for such informative post

वाह बहुत ही उत्तम जानकारी..इस ज्ञानवर्धक पोस्ट के लिए आपका धन्यवाद😊 🙏

helpful informative post sharing

Very useful info’s. Thanks for the post.

I must admit, I’m pretty lax at tracking all my expenses, but tend to use one major credit card that does not charge any foreign transaction fees and also get mileage out of. So in a way using this card does track the major expenses. Great tips on doing this meanwhile.

This is indeed a very interesting topic that not enough people discuss! I love the idea of using foreign exchange prepaid cards, we never used them before but they might come in handy on one of our trips, thank you!

While we are the type who just saves then go, managing our finances when on travel has never really been thought of nor planned. Not until now, however, wherein we are starting a family and we still plan on going on trips (and maybe travel long term in the next few years). This is such an informative post, Vasu and will be very helpful for us. Personally, tracking our expenses and start pooling more funds as well as utilising cards (debit and credit) is definitely a great way to start managing our finances for the meantime. 🙂

Looks like you research and plan similar to us, though we don’t have the currency issue of rupees here in UK. But we do similar estimate of funds needed and then make sure we have an extra incase!

For me, traveling on a strict budget for long periods of time, I find it’s really important to update my expense spreadsheet every day. Otherwise, it’s so easy to underestimate just how much you spent and get carried away with things and find yourself with no money at the end of the trip.

We usually exchange before heading to the new destination, it is cheaper. Since we are based in the UK, we always have Euros, because we travel more often to European countries. We also track our expenses through an app

The Forex card is a good idea. I’m not sure if I’ve heard of that option, though I admit to being pretty old school with how I deal with money while traveling. Cash is definitely the best, because so many places just don’t take anything else. I use the same trick – spreading my cash around all over my luggage. Sometimes I hide it so well, that I can’t find it myself and then I find it once I’m in a different country and need a new currency. Haha!

As a fellow long-term traveler (I was traveling for 6 years straight at one point) I agree with a lot of what you wrote here. Although I don’t have put time limits on how many days/weeks/months I stay in one place so I don’t budget for the number of days I spend in one place. I rather do go by similar rules of thumb and your right about having different pools and variations to keep your money in. Very good read 🙂

Great tips here. Definitely having Indian bank accounts makes things more challenging with the rules in place. I like the idea of a forex card for anyone, curious to see the benefits of currency conversion. Agree with you on having bank cards and credit cards from different banks – definitely a great safeguard.

wow,, great information….i remember once i stuck in thailand because of currency problem…

Thank you for this post. This contains a lot of really useful info that we can use when travelling.

I was really interested in reading about the Forex card and will need to see if I can get one in Canada (or in Europe when we land next). On our recent trip we needed 5 different currencies and we lost money buying and selling as we moved from country to country. We also travel and use one credit card that has a very low balance to reduce the financial risk. It is good to remember that Western Union is also a good backup solution in case of emergency. My son was travelling and lost his wallet. I was able to send him money to Western Union in Vietnam in one day. The other thing I do is travel with US $$ (we are Canadian). The exchange rate for US $$ is generally better than Canadian. I have a US $$ bank account so I can take it out of there to travel.

What a useful post! It’s always a dilemma how to distribute funds to avoid losses, charges etc whilst travelling. I’ve used the money cards before and they’ve worked really well. I still write all our daily expenses down in a little book and add it up at the end of the day. We try to set ourselves a daily budget which works really well. I never thought of reducing our credit card limits to reduce risk! Thanks for all the info.

Great read, thanks for this! I do not use foreign exchange prepaid cards but I think I now will!

I really appreciated this article. It was well thought out and quite useful. I take so many thing for granted being a US traveller and having my funds automatically set in a “hard” currency. Even then, travelling through Thailand or Sri Lanka, we learned how different it is to access your money abroad. I love your advice on how to stay on budget and I definitely agree with your rule of thirds on expenses.

Great tips! I have not heard of Forex cards. It seems like a great card to have and save troubles with exchanging foreign currency. I will need to look into it!

It is an interesting idea to reduce the spending limit on credit cards. That way, you can can multiple cards and divide the risks. A friend of mine keeps a spare card in a hidden pocket for emergencies. One can never be too careful in managing funds while travelling.

Managing finance while travelling is a fine art in itself. You have provided some valuable pointers that are bound to be useful. We too rely on forex cards, credit cards and currency. We also end up with coins of varying currencies, shapes, and sizes, many of them have found a place in our showcase! Budgeting is another important aspect that we focus on and usually budget for everything under the sun.

I love the way you have put together this post – pros and cons of every type of forex units. It makes it easier for anyone to figure out what would work for them. I must check with Nisha on where she hides the cards or cash – would help me in a lot of ways ;-). I somehow have never been able to work well with a travel card except in Europe. Asia works better with cash and credit card I think. I guess, maybe I should try out a travel card here too.

We don’t track expenses at all when we go on vacation. We’re on vacation! Obviously, if you’re not responsible with your money then writing up a budget and sticking with it is probably a good idea. But it’s just not something we have to worry about doing since we never go crazy with spending.

That is such a wonderful post. It has actually solved my so many doubts regarding the Forex cards. We do carry cards but never thought about carrying two of them. I think your logic behind it is quite valid. So will love to do it for my next trips.

This is a such an informative post. Loved the way you describe things so clearly in easy to understand words. I must admit I didn’t knew much about travelling abroad before I came across this post. I am sure it will help us in our future travels.

Thanks for sharing 🙂

नमस्कार , बहुत अच्छा लगा आपके ब्लाग पर आकर । मैं पिछले 6 साल से लिख रहा हू । पहले भी कई ब्लाग बनाये और फिर बीच मे ब्लाग पर लिखना कम करके अपने लैपटाप पर ही लिखने लगा हू । अब फिर से ब्लाग पर सक्रिय होने जा रहा हू । आपका सहयोग रहेगा तो वापसी अच्छी कर पाऊंगा ।

मेरे ब्लाग पर आईयेगा,मैं वादा करता हू आपको निराश हो कर नही लौटना पडेगा ।

धन्यवाद ।

Really great tips for people like me who just can’t make any savings. I have never been good with worldly affairs. No wonder I have been stuck in one country with such lack of planning. LOL

I do exactly as you, I create an excel sheet to track all expenses and create a high level plan to calculate the budget, dividing it into 3 categories, flights/ visas, accommodation & misc. People say I am such a geek LOL but that’s what I tell them, I am organised, and you kind of have to be if you’re a budget traveller, don’t you? At least I don’t end up lost about how much money I have spent or cry about having spent too much! I like to be in control 🙂